aurora co sales tax calculator

This includes the rates on the state county city and special levels. Annually if taxable sales are 4800 or less per year if the tax is less than.

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

Aurora in Colorado has a tax rate of 8 for 2023 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

. This is the total of state county and city sales tax rates. To calculate the sales tax on your vehicle find the total sales tax fee for the city. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city.

Get rates tables What is the sales tax rate in Aurora Colorado. Sales Tax Calculator in Aurora CO. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Sales tax in Aurora Colorado is currently 8. 2020 rates included for use while preparing your income tax deduction. The December 2020 total local sales tax rate was also 8000.

Creating tax levies evaluating property worth and then receiving the tax. Multiply the vehicle price after trade-ins but before incentives by the. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Aurora OR Sales Tax Rate. The average cumulative sales tax rate in Aurora Colorado is 831 with a range that spans from 675 to 881. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county.

You can find more tax rates and. The current total local sales tax rate in Aurora CO is 8000. In general there are three steps to real estate taxation namely.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax. The minimum is 29. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city.

Under state law the government of Aurora public. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. 24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora Colorado Sales Tax. The most populous zip code in Aurora.

This rate includes any state county city and local sales taxes. The current total local. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe.

Name A - Z View all businesses that are OPEN 24 Hours. This includes the rates on the state county city and special levels. Colorado has a 29 statewide sales tax rate but.

As far as all cities towns and locations go the place with the highest sales tax rate is Plankinton and the place with the lowest sales tax rate is Stickney. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Before-tax price sale tax rate and final or after-tax price.

Aurora is located within Lawrence County Missouri. The average cumulative sales tax rate in Aurora Missouri is 885.

Missouri Car Sales Tax Calculator

Illinois Sales Tax Rates By City County 2022

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation

How To Calculate Cannabis Taxes At Your Dispensary

Colorado Sales Tax Calculator And Local Rates 2021 Wise

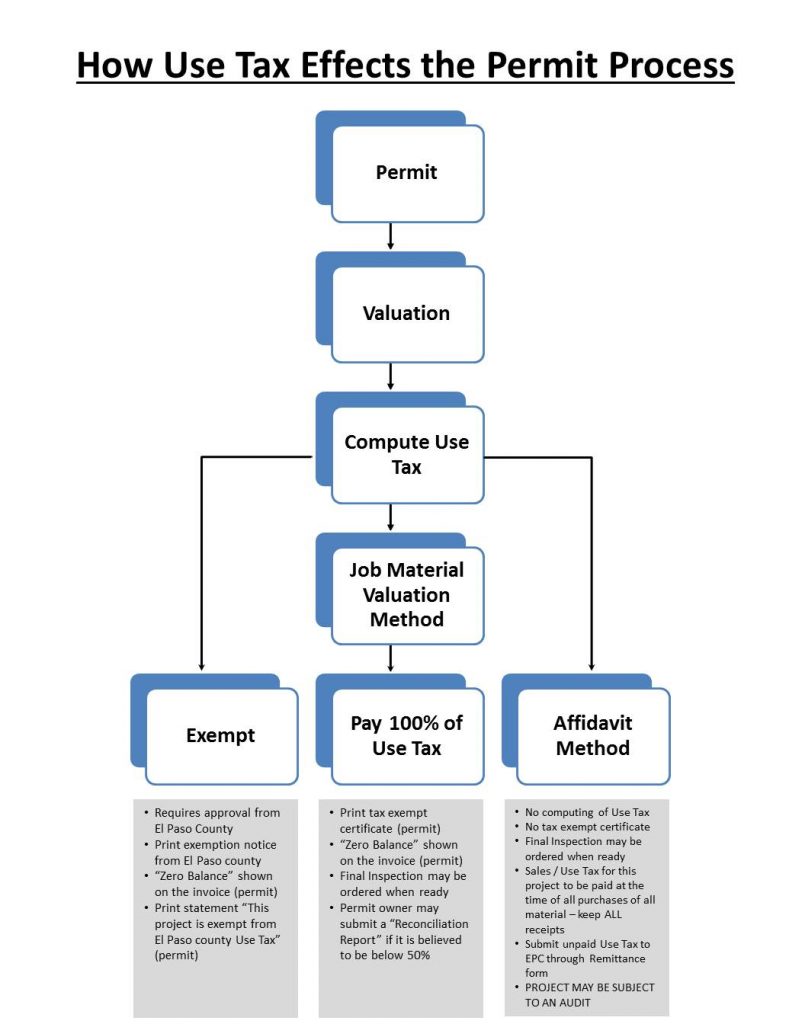

Sales And Use Tax El Paso County Administration

Desktop Tax Calculators Aos Online

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Property Taxes By State Quicken Loans

How To Use Tax Function On Calculator Youtube

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Motor Vehicle Repair Industry Guide

Colorado Aims To Simplify Local Sales Tax Collection For Remote Sellers

How Colorado Taxes Work Auto Dealers Dealr Tax

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725